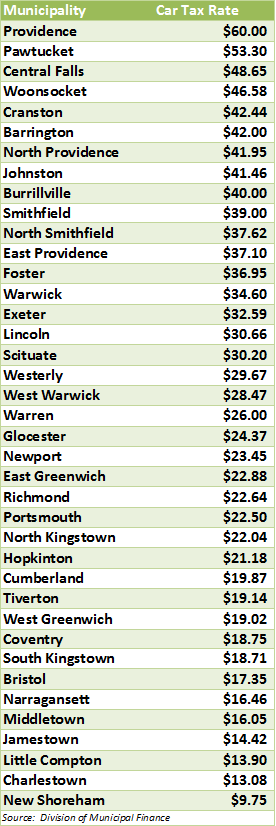

rhode island tax rates by town

2022 List of Rhode Island Local Sales Tax Rates. 135 of home value.

Historical Rhode Island Tax Policy Information Ballotpedia

Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax.

. Rhode Island Taxable Income Rate. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Tax amount varies by county.

Recreational services or road maintenance in the town where they are located. 2 Municipality had a revaluation or statistical update effective 123119. About Toggle child menu.

The table below shows the income tax rates in Rhode Island for all filing statuses. Rhode Island Tax Brackets for Tax Year. 41 rows Map and List of Rhode Island Property Tax Rates - Lowest and Highest RI Property Taxes - Includes Providence Warwick and Westerly.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Average Sales Tax With Local. State of Rhode Island Division of Municipal Finance Department of Revenue.

Rhode Island has state sales. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. 3 West Greenwich - Vacant land taxed at.

FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value. Rates include state county and city taxes. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

2020 rates included for use while preparing your income tax deduction. However the average effective property tax rate is 163 which is more than the average US. If youre married filing taxes jointly theres a tax rate of 375.

Breakdown of RI Fire Districts by CityTown Tax Rates for 2020 - Assessment date 123119. The latest sales tax rates for cities in Rhode Island RI state. Less than 100000 use the Rhode Island Tax Table located on pages T-2.

1 Rates support fiscal year 2020 for East Providence. Rhode Island property tax rates are set by cities and towns depending on the budget they require to provide their mandated services. Rhode Island By Angie Bell August 15 2022 August 15 2022 Little Compton has the lowest property tax rate in Rhode Island with a property tax rate of 604.

The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Rhode Island property taxes vary by county. A list of Income Tax Brackets and Rates By Which You Income is Calculated.

Dec 24 2012 - Explore The DiSpirito Teams board RI Real Estate Tax Rates by Town on Pinterest. Effective property tax rate of 11. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately.

The rates are expressed in dollars per 1000 of assessed. Rhode Island has a. Rhode Island also has a 700 percent corporate income tax rate.

Detailed Rhode Island state income tax rates and brackets are available on. See more ideas about estate tax rhode island towns. 15 Tax Calculators.

RI or Rhode Island Income Tax Brackets by Tax Year. Town Residential Real Estate.

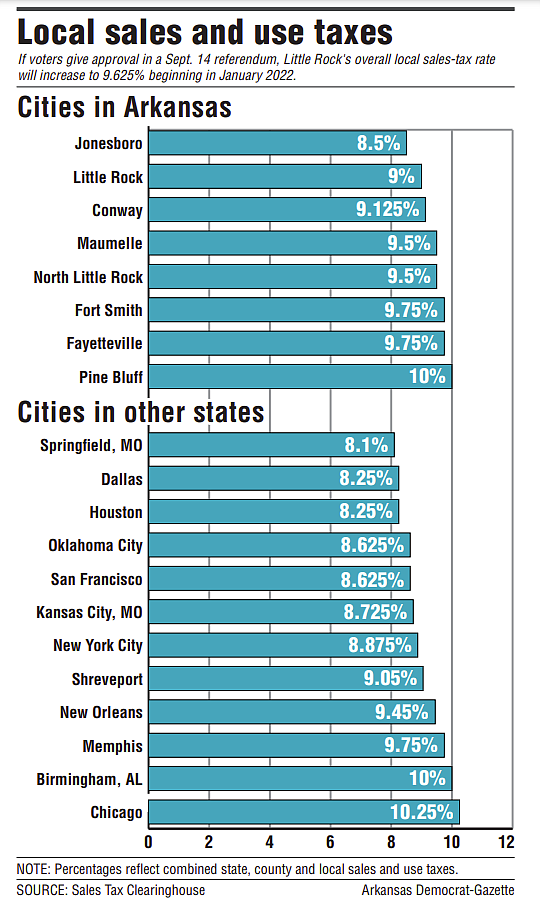

How Do State And Local Sales Taxes Work Tax Policy Center

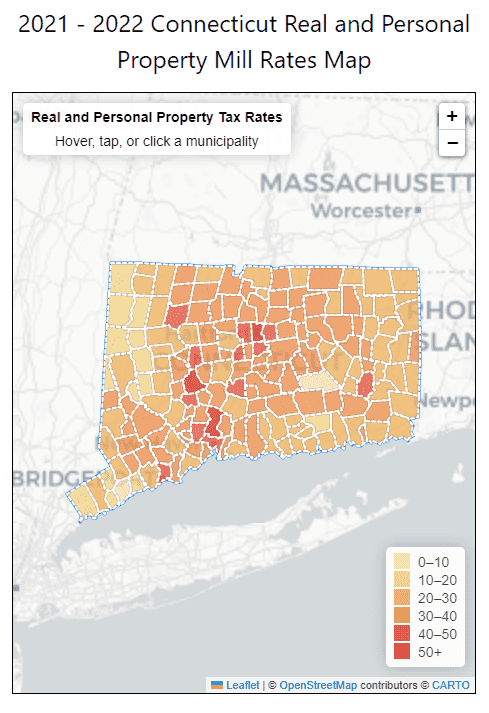

79 Ct Munis Raised Property Tax Rates For New Fiscal Year Hartford Business Journal

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Tax Collector Town Of Hopkinton Rhode Island Usa

Map Of Rhode Island Property Tax Rates For All Towns

Golocalprov The Highest Car Taxes In Rhode Island

Rhode Island Ranks As The 8th Most Heavily Taxed State In America Newport Buzz

2022 Property Taxes By State Report Propertyshark

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

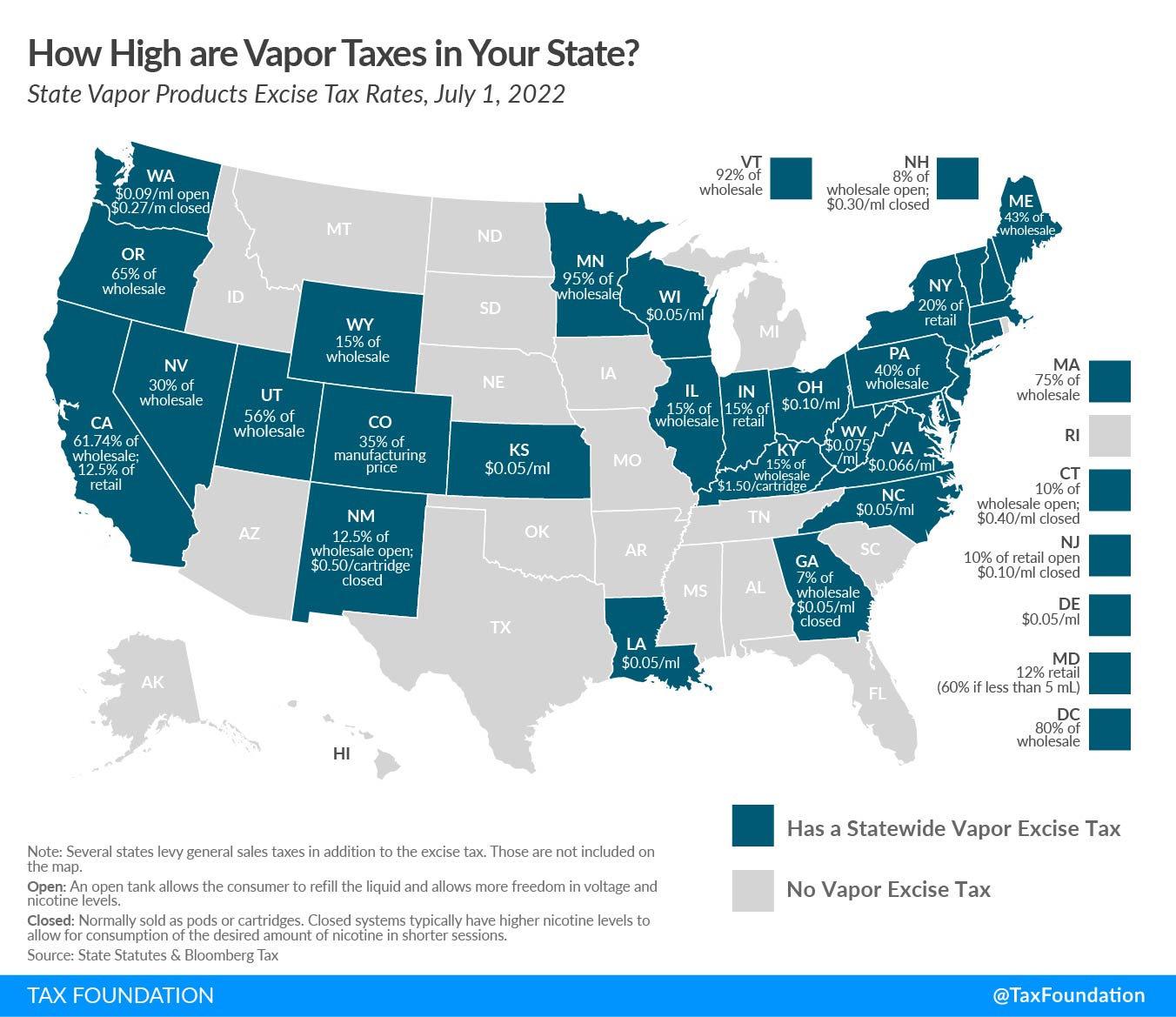

State Taxes In Every Us State And Dc Ranked Lovemoney Com

As Tax Rates Go Arkansas At Top

Rhode Island Companies Will Face Higher Taxes Than China And Europe If Dem Bill Passes Americans For Tax Reform

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation